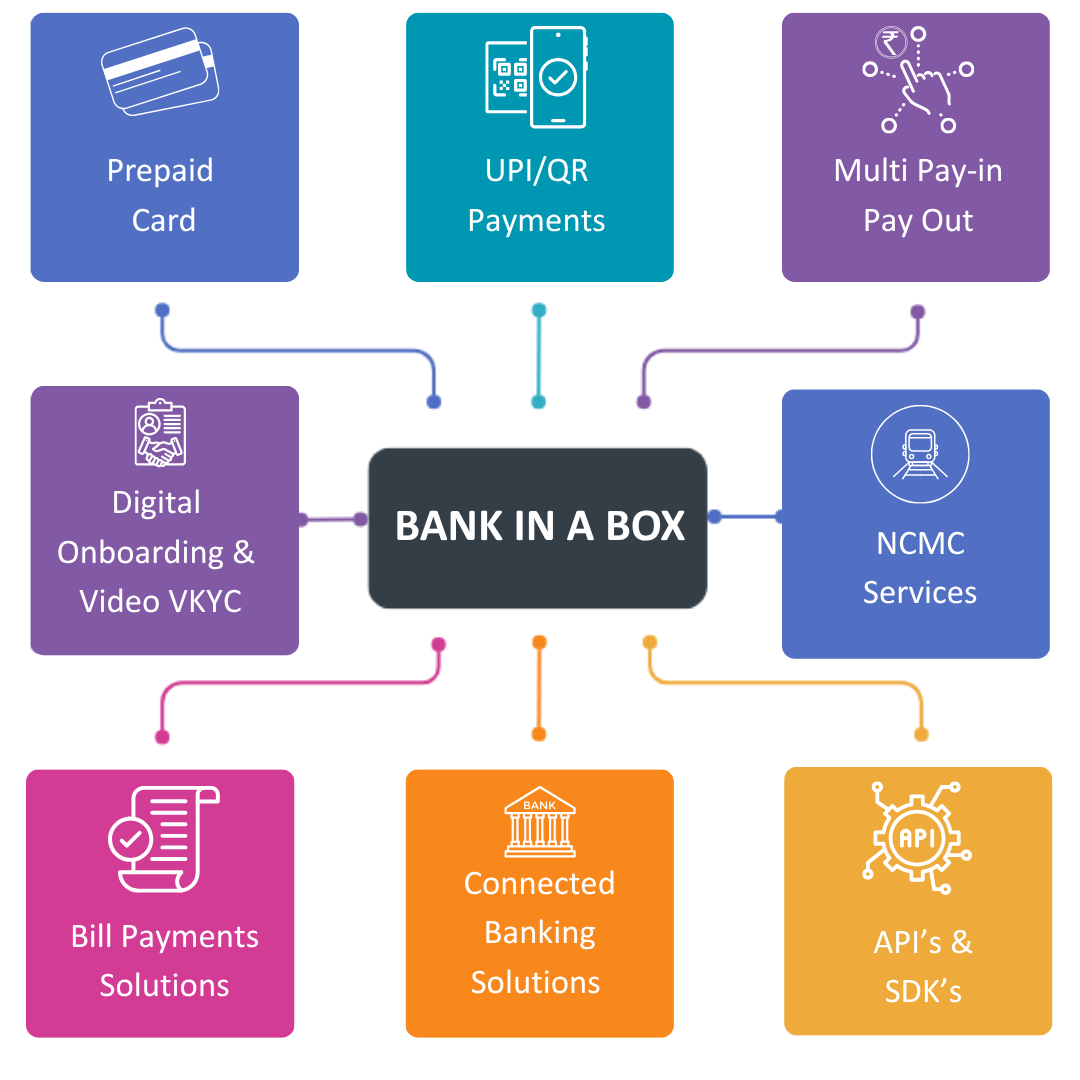

Bank In a Box

A complete suite of financial services within Super App

MufinPay's "Bank-in-a-Box" a complete suite of financial services

MufinPay’s “Bank-in-a-Box” offers a complete suite of financial services within its Super App, including Prepaid Cards, UPI/QR, Value Added Services, NCMC,

Pay-in/Pay-out, API’s & SDKs, Seamless Digital Onboarding and Video KYC. MufinPay ensures secure, efficient transactions for businesses and users.

Prepaid cards

- RBI-licensed PPI (Prepaid Payment Instrument) cards.

- Reloadable GPR (General Purpose Reloadable) cards for everyday use.

- Corporate gifting and employee expense management.

- Secure, personalized card issuance with real-time tracking.

UPI & QR Payments

- QR Payments: Scan & pay—no bank details needed.

- Mufin Handle: Use your @mufin UPI ID for brand visibility.

- No Bank Needed: Create UPI ID without linking a bank account.

- Acceptance: Receive payments from any UPI app.

- Secure PIN: Every transaction is PIN-protected

Multi Pay In/Pay out

- Automated Collections – Accept payments via UPI, QR, or dynamic VPA for EMIs & invoices.

- Dynamic VPA Mapping – Unique VPA per transaction for easy reconciliation.

- Bulk Payouts – Manage or schedule thousands of payouts with ease.

- Smart Dashboard – Monitor, manage & analyze transactions seamlessly.

Digital onboarding & Video KYC

- Real-time identity verification via live video.

- Compliant with RBI and regulatory norms.

- AI-powered document matching and facial recognition.

- Multi Language Support.

- Account activation within minutes.

NCMC Services

- NCMC Top-Up Recharge: Supports metro, bus, and public transport across India.

- Unified Transit Payments: One card for multi-city, multi-mode travel.

- Real-Time Confirmation: Instant updates after successful recharge.

- Multi-Modal Integration: Perfect for metro, bus, and rail commuters.

- Secure & Compliant: UPI-based transactions aligned with NPCI standards.

Bill Payment Solution

- Mobile, DTH, electricity, gas, water, and broadband recharges.

- Instant processing with wide service provider coverage.

- Simplified UI for recurring payments and reminders.

- Enhances user engagement and retention.

Connected Banking Solutions

- Neo-banking experience with real-time transaction access.

- Integration with banking services for fund. transfers and account management.

- Streamlined business transactions and working capital movement.

- Designed for both personal and business finance management.

API's & SDKs

- Fully customizable payment infrastructure under your brand

- Seamless integration with existing apps and platforms

- Scalable APIs for prepaid cards, wallets, and payment modules

- Ideal for NBFCs, fintechs, and service aggregators